Credit Card Users’ Behavioral Segmentation

The aim of the following case was to do customer segmentation in order to develop a marketing strategy. The dataset contained credit card usage of around 9000 active users for the last 6 months. Data pre-processing involved appropriate handling of missing values and outliers as well as dropping any variable that was irrelevant to the task of segmentation e.g. Customer ID. A correlation matrix was constructed to see any obvious dependencies between different variables that should be taken into account before applying the clustering algorithm.

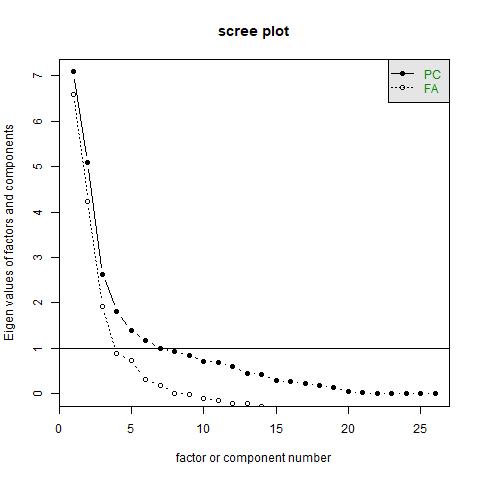

The original 18 of behavioral variables were used to derive intelligent Key Performance Indicators (KPIs) in order to build an enriched customer profile. The KPIs were then explored to gain some insight on the customer behavioral patterns. Factor analysis was used for dimension reduction to arrive at 8 underlying factors. The number of factors were decided using the Kaiser test and scree plots. The reduced factors were used to cluster similar credit card users into segments using K-means.

Here is a scree plot that let us decide the number of factors to be used.

Visit the Github Repository here.

Directly download the final report with complete analysis and results here.